Alternatives to Traditional

Commercial Real Estate

in Southern California

Do you need a commercial real estate lending solution in Southern California?

Traditional loans are not right for every business.

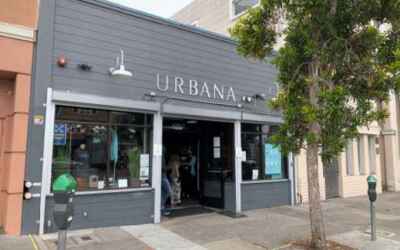

Purchase of Retail Store and Lounge

- Loan Amount * $2,250,000

- Collateral Valuation: * $3,900,000+

- Term * 12 months, First Lien, IO

- For example, loans backed by the Small Business Administration (SBA) generally require a business credit score of 680, at least two years in business and occupancy of the property by the mortgage holder. SBA-backed loans can take up to 90 days for approval and funding.

- Traditional bank-offered mortgages may require an even higher business credit score of 700 and a larger down payment of at least 15 percent of the purchase price. These loans are available to businesses that have been in operation for at least two years and can take up to 90 days for approval and disbursement of funds.

Why should you consider an alternative real estate lending company in Southern California?

Alternative commercial mortgages offer exceptional flexibility for your business, especially if you have had credit difficulties in the past or have only recently started your company. By exploring available alternatives to the big banks and government-backed lending arrangements, you can derive significant benefits that include some or all of the following:

- Lending arrangements that are tailored to suit the needs of your business and your cash-flow requirements

- High-tech options for filing and updating paperwork and securing your confidential financial information

- Easier credit terms that can increase your chances of approval for your business real estate loan

- Faster approval and disbursement of funds, allowing you to take advantage of opportunities in the fast-paced Southern California real estate market

- Less paperwork required to document your eligibility for these loans

Some of the best options for small businesses are found in the alternative lending sector of the financial industry. By considering these options when planning your real estate acquisitions, you can make the best choice for your business and your financial bottom line.

Purchase of Timberland in Humboldt County

- Loan Amount * $1,000,000

- Rate *9.50%

- Appraised Value * $2,000,000

- Term * 12 months, IO

- Lien Position * First

Alternative commercial real estate loans could provide the right solutions for your business.

- Bridge loans are a type of short-term financial arrangement that can help you navigate cash-flow issues that can occur during the sale of one property and the acquisition of another.

- Development loans are ideal for construction companies that require investment capital to complete their building projects. Funds from development loans are available for use to improve properties intended for sale or lease in the Southern California real estate marketplace.

- Private money loans sometimes require higher interest rates to compensate for the higher degree of risk assumed by investors. These loans may be made available by individual investors or groups.

- Hard money loans are usually based solely on the value of the property to be purchased rather than on the credit history of the borrower or the business. If you have had credit problems in the past, this approach can allow you to get the funding you need to acquire new properties in Southern California.

If you are looking for the most appropriate commercial mortgage for your needs, considering alternative lending options could help you achieve your goals more quickly and easily.

Can you afford to overlook alternative commercial mortgage lenders?

Making sure you can access the lending arrangements needed to expand your territory and grow your business is essential to your ongoing success. By exploring traditional and alternative lending options and choosing the most cost-effective solution for your company, you can achieve greater profitability and increased revenues in the competitive Southern California economy.

If you are in need of an alternative lender in the Southern California area, be sure to contact ReProp Financial today!