EXPLORING

COMMERCIAL REAL ESTATE

LENDING OPTIONS

IN OREGON

STARTING AT 8.99%

ARE YOU LOOKING FOR A COMMERCIAL REAL ESTATE LENDING ARRANGEMENT IN THE STATE OF OREGON?

Reduced paperwork

Faster Processing

Ability To Customize

Advanced Technologies

Easier Qualification Terms

Private Money Loans

Short-Term Construction Loans

Hard Money Loans

Asset-Based Loans

Development Loans

Call or Email

Reach out and get started!

1-800-444-2948

Guidance and Support

Fast and Accurate

Wider Funding Options

More Bargaining Power

Peace of Mind

Call or Email

1-800-444-2948

Secure Cost-Effective and Stress-Free Commercial Real Estate Financing in Oregon

Today, it can prove to be quite difficult to secure commercial real estate financing in the state of Oregon. This is especially the case if you happen to be a new developer who isn’t conversant with the ins and outs of such complex financial negotiations. Should you find yourself in such a position, picking the suitable lender and the suitable financing will make a big difference. More so when it comes to reducing the overall costs of the loan you will incur and the availability of funding for your commercial real estate dream in Portland, Eugene, Corvallis, or any other cities in the state of Oregon.

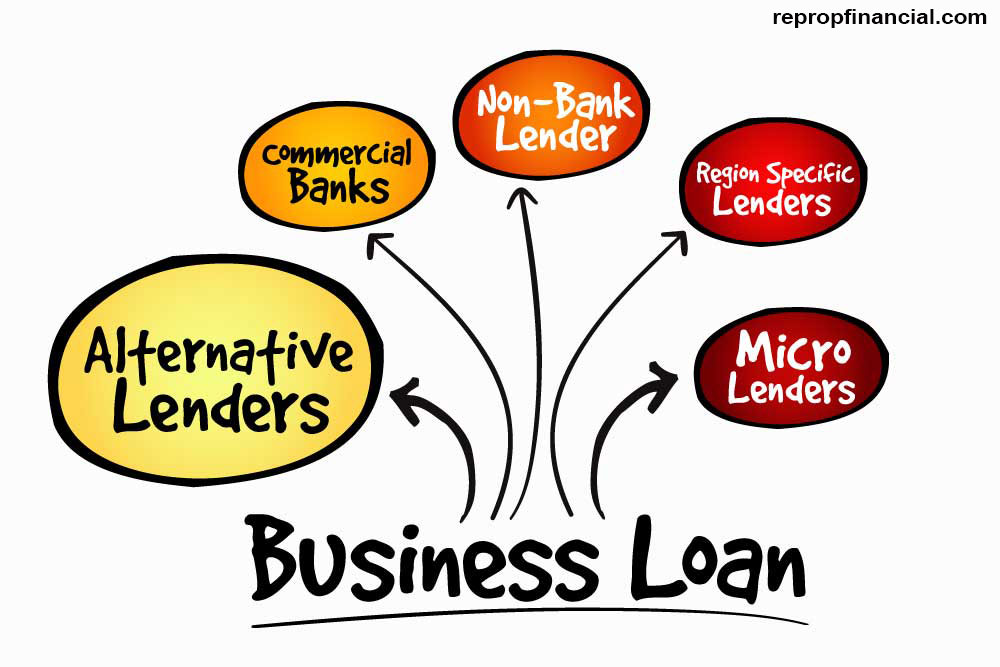

Ever since the 2008 Great Recession, traditional lenders like banks and other mainstream financial institutions began to be more conservative when it comes to underwriting for commercial real estate borrowers. When it comes to banks, many have increasingly become reluctant of such lending due to a number of factors. One of the most notable of which is the new stringent regulations that were enacted after the financial crisis such as the Tier 1 Capital requirements along with the high volatility commercial real estate (HVCRE) laws. However, there is still hope yet if you may be on the lookout for funding for your commercial real estate project in Portland or other key cities. Tight requirements from traditional lenders, increased borrower demand, and mounting interest rates imposed on new borrowers have all contributed to the rise of alternative lenders just like ReProp Financial in Oregon.

to be the only viable solution left to you in Oregon

Alternative lenders like ReProp in Oregon are noted for not being in any way bound in a straightjacket by the HVCRE regulations. This means their terms and requirements are more flexible and less stringent toward new commercial real estate developers. In some given situations, these alternative lenders can prove to be the only viable solution available to new borrowers. Alternative commercial real estate financing brings much more to the table when compared to the recent trends among traditional lenders, particularly for those who are just diving into the real estate developing sphere. When it comes to loan approval requirements, alternative lenders aren’t as rigid as banks. On average, in today’s traditional lending environment in Eugene, it would take you between 60 – 90 days to secure a commercial real estate construction loan. Additionally, this doesn’t factor in the high odds of issues arising in the appraisal process or even the loan documentation process.

Let us now take a closer look at some of the most common commercial real estate loans you can access from a reputable alternative lender like ReProp Financial.

Development loans

This is a reliable financing solution particularly if you are thinking of initiating a new commercial real estate construction project in Oregon. ReProp Financial offers development loans primarily to construction firms in Portland, Eugene, Corvallis, or any other cities. Best of all, they are to be had with terms that are extremely flexible for developers who wish to obtain financing for both new construction or to execute extensive renovations.

Hard money lending

This sort of commercial real estate funding tends to be structured as most traditional loan solutions. However, the beauty of it is unlike the terms of bank financing, you might be in a good position to secure funding even if you’ve experienced significant credit issues in the recent past.

Collateralized/asset-based loans

Short-term construction loans

Otherwise referred to as bridge loans, this kind of commercial real estate financing is made available for developers who wish to offset expenses and effectively meet all cash flow needs during the time between commencing a construction project to the actual sale of the completed property. The short-term construction loans ReProp Financial offers are specially designed to deliver extra support for developers who experience cash flow challenges over the course of their commercial real estate construction projects.

Private money loans

A private money loan, as the name suggests is made available by private investment groups or even an individual venture capitalist. This kind of commercial real estate financing tends to be structured in a similar manner as a bridge loan. Also, like the latter solution, it is meant to cater to commercial real estate investors or developers who are experiencing issues with cash flow over the course of their construction projects. It may as well deliver the necessary financial support for new property acquisitions or renovation projects.

How to Apply

Call us today at 1-800-444-2948 or visit us online to submit your loan request. We look forward to the opportunity to work with you.